THE R&D TAX CREDIT EXPLAINED

The Research and Development (R&D) tax credit is a

Federal tax incentive that rewards taxpayers for

increasing investment in U.S.-based research activities.

This credit was first introduced by Congress in 1981 and made permanent on 2015. The R&D tax credit is available to businesses that design, develop, or improve products, processes, techniques, formulas, or software. Correctly calculating and properly documenting the R&D tax credit is critical because it can greatly lower taxes and increase cash flow.

QUALIFICATIONS

The R&D tax credit is available to taxpayers who incur incremental expenses for Qualified Research Activities (QRAs) conducted within the U.S. While primarily a wage-based credit, the credit is comprised of the following Qualified Research Expenses (QREs):

Internal wages paid to employees for qualified services; this includes those individuals directly performing the science as well as those individuals directly supporting and supervising these individuals.

Basic research payments made to qualified educational institutions and various scientific research organizations.

Contract research expenses (when someone other than an employee of the taxpayer performs a QRA on behalf of the taxpayer, regardless of the success of the research).

Supplies used and consumed in the R&D process.

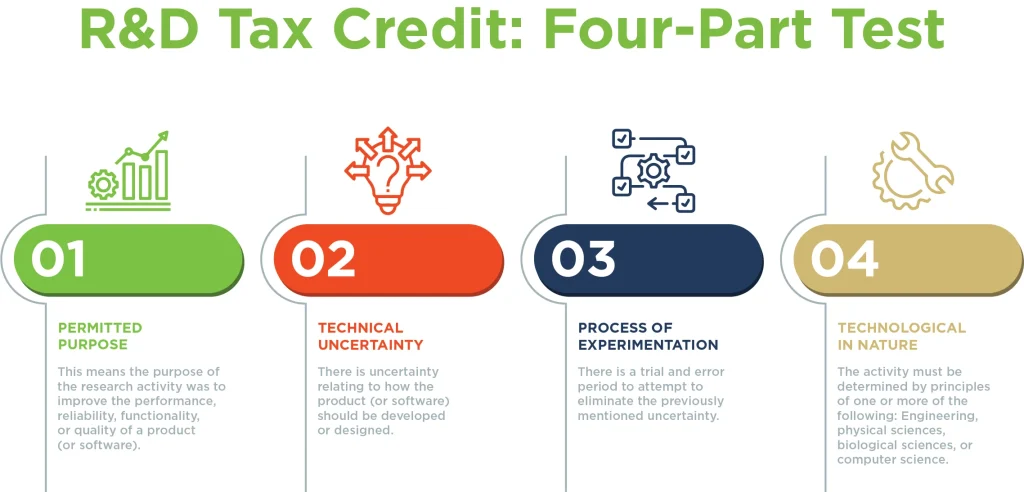

Research activities must meet the four part qualification test

R&D TAX CREDIT DOCUMENTS

Click on document image to open PDF in a new browser window.

R&D Tax Credit

This document shows a brief overview of the R&D Tax Credit

R&D Tax Credit One Pager

This document is a one page overview of the R&D Tax Credit